pay utah corporate tax online

Pay Real Property Tax. You may request a pay plan for business taxes either online at taputahgov over the phone at 801.

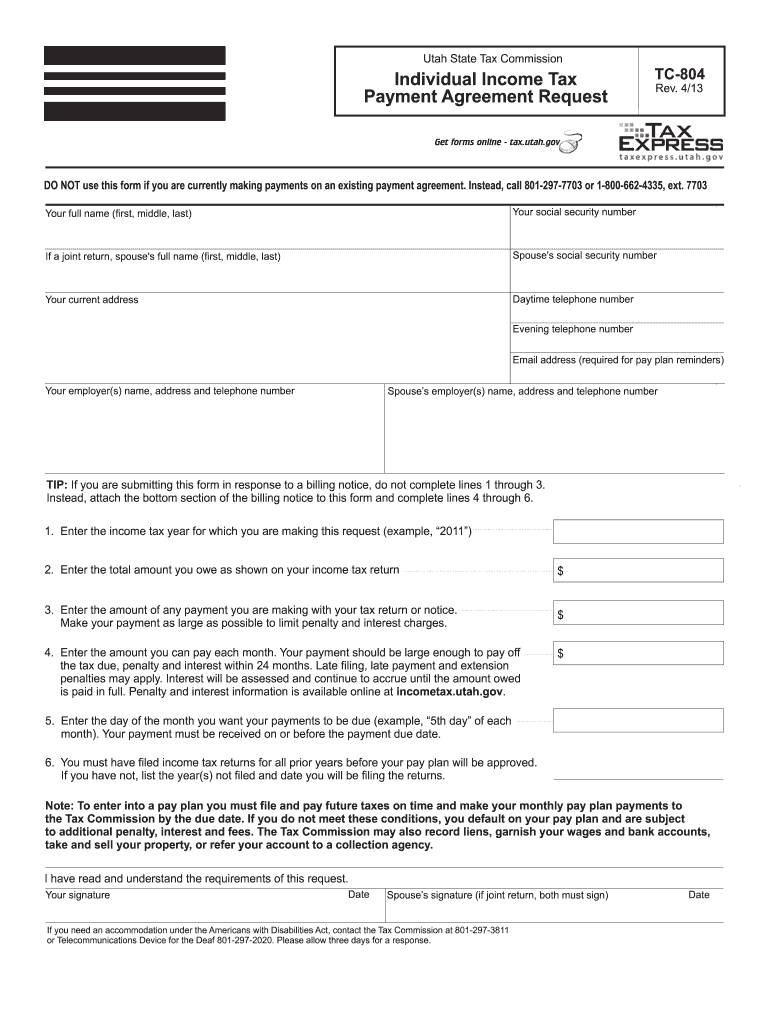

Ut Tc 804 2013 Fill Out Tax Template Online Us Legal Forms

You must pay your Corporation Tax 9 months and 1 day after the end of your accounting period.

. Salt Lake City UT 84134-0266. Pay Utah Corporate Tax Online. Utah State Tax Commission.

Filing Information Free Paid Tax Software Websites. The Doing Business As. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks.

Filing Paying Your Taxes. LLCs operating in Utah that elect for taxation as. Write your daytime phone number and 2021 TC-40 on your check.

Do not staple your check to your return. The corporate income tax in Utah is generally a flat rate of 5 percent of the taxable income of the business. Your accounting period is usually your financial year but.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. You can pay business income taxes in person at one of the Utah State Tax Commission Offices or via mail to. A corporation that had a tax liability of 100 the minimum tax for the previous.

Please contact us at 801-297-2200 or. Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or. You can also pay online and.

210 North 1950 West. Utah has a flat corporate income tax rate of 5000 of gross income. The minimum tax if 100.

A corporation that had a tax liability of 100 the minimum tax for the previous. 1 2022 Please be aware that many of our processing. The federal corporate income tax by contrast has a marginal bracketed corporate income taxUtahs maximum.

Do not mail cash with your return. The minimum tax if 100. Taxable profits of up to 15 million.

Remove any check stub before sending. Pay Utah Corporate Tax Online.

Doing Business In Utah Utah State Tax Commission Utah Gov

With No Legal Sports Betting Utah May Be Losing Millions In Tax Revenue Kutv

Utah State Tax Commission Notice Of Change Sample 1

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

A Better Designed Tax Bill In Grand County Utah Center For Civic Design

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

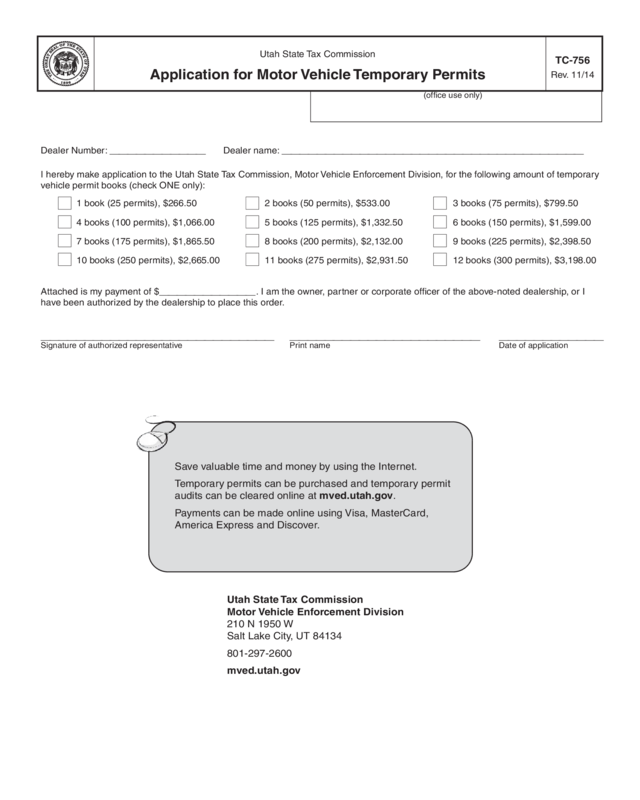

Tc 756 Application For Utah Motir Vehicle Temorary Permits Edit Fill Sign Online Handypdf

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

File Your Own File Taxes For Free Earn It Keep It Save It Utah

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Federal And State Tax Forms Payson Utah

Tax Preparation In Utah Tax Specialist Holyoak Company

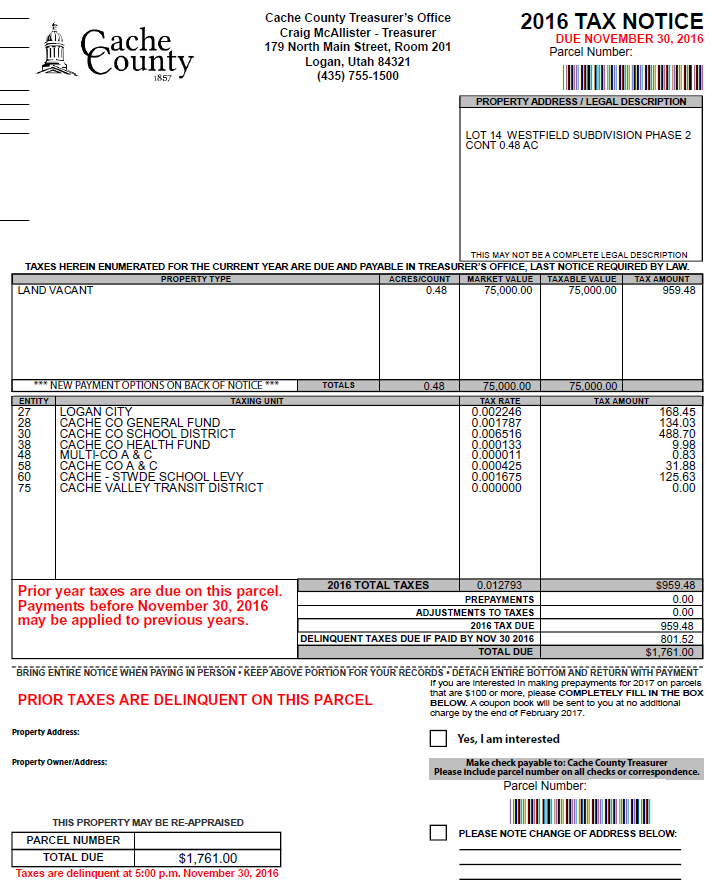

Official Site Of Cache County Utah Paying Property Taxes

Utah State Income Tax Return Information Prepare And Efile Now

Utah Income Tax Calculator Smartasset

Utah State Tax Commission Official Website

Online Sales Tax Decision Could Give Utah Another 60 Million

Find Utah Military And Veterans Benefits Information On State Taxes Education Employment Parks And Recreation And Va Facility Locations The Official Army Benefits Website